net wealth tax luxembourg

It was reintroduced during the financial crisis in the country and it is a tax that must be paid on top of other. The private wealth practice at Fladgate LLP focuses on complex tax and wealth structuring issues for domestic and international clients including entrepreneurs families and fiduciary businesses.

Why Luxembourg Remains Attractive For Investment Kpmg Global

The evolving role of Tax.

. Luxembourg red Net pension wealth Indicator. The wealth tax in Spain also known as impuesto de patrimonio is a tax that both residents and non-residents must pay on their assets. As corporate entities they are taxpayers and subject to the tax on companies called corporate income tax.

National accounts survey data fiscal data and wealth rankings. Founded in 1977 TMF Group in Luxembourg has a dedicated international and multicultural team of industry specialists in accounting legal tax payroll and HR serving private clients international corporate clients stock-listed multinationals and private equity and real estate investment structures both locally and internationally. Some weaknesses of the Luxembourg tax system.

Good first steps would be campaign law reform with perhaps a constitutional amendment in the case of the US an additional 2 corporate tax on income in excess of say 5000000 an additional 2 tax on personal income world-wide in excess of say 500000 a reduction of income tax of 5 of income less than say 50000 and increased. Total of GDP 2001-2020 Luxembourg red OECD - Average black Total. 46 Total of GDP 2020 Luxembourg of GDP.

A 7 solidarity surtax is imposed on the CIT amount. Citation needed It was one of the Socialist Partys 1981 electoral platforms measures 110 Propositions for FranceFirst named IGF Impôt sur les Grandes Fortunes it was abolished in 1986 by. For decades asset and wealth management clients have relied on PwC to help shape their businesses.

Look forward to a secure future - with our far-sighted comprehensive wealth planning. If the taxpayers assessed net worth is 450000 and the wealth tax is 24 then the tax debt for the year will be 24 x 450000 108000. Net wealth tax is established using the general tax base in other words by assessing the taxable wealthThe tax applies to opaque companies.

Shining light into dark places. Jonathan Riley joined the firm from Michelmores LLP to spearhead the group. The solidarity tax on wealth French.

Resident opaque companies are taxed on their global wealth wealth held in Luxembourg and abroad. Colombia levies a net wealth tax and a financial transactions tax. Estate duty is the name for inheritance tax in South Africa which is a property tax payable on all estates with a net worth in excess of R3500000.

At 31 percent Colombias corporate income tax rate is significantly above the OECD average 229 percent. Luxembourg provides companies with the capability to establish and adopt business regulatory and tax framework for added-value activities in Europe and beyond. And thanks to Luxembourgs 100 tax exemption for dividendsa break that kicks in after a holding company has kept at least 14 million worth of stock or 10 of a companys shares for a year.

Secrecy jurisdictions a term we often use as an alternative to the more widely used term tax havens use secrecy to attract illicit and illegitimate or abusive financial flows. The role of tax has evolved to become a catalyst for delivering trust and driving strategic business outcomes. Luxembourg red Tax on corporate profits Indicator.

Shares in the fund are bought and sold based on the funds current net asset value. 188 Men Multiple of annual gross earnings 2020 Luxembourg Multiple of annual gross earnings. The evolving role of Tax.

Impôt de solidarité sur la fortune or ISF was an annual direct wealth tax on those in France having assets in excess of 1300000 since 2011. It also has considerable strength in family office work as it acts for. By doing so it becomes possible to track very precisely the evolution of all income or wealth levels from the bottom to the top.

The tax rate in South Africa for estate duty is 20 of properties worth up to R30. An estimated US21 to 32 trillion of private financial wealth is located untaxed or lightly taxed in secrecy jurisdictions around the world. It has been replaced by a minimum net wealth tax see Net wealth tax NWT in the Other taxes section.

Corporate income tax impôt sur le revenu des collectivités - IRC is a special proportional tax levied on gains made by certain corporations including capital companies during the financial year. Although there used to be a minimum CIT for Luxembourg resident companies no such minimum CIT is applicable as of 2016. A wealth tax also called a capital tax or equity tax is a tax on an entitys holdings of assetsThis includes the total value of personal assets including cash bank deposits real estate assets in insurance and pension plans ownership of unincorporated businesses financial securities and personal trusts a one-off levy on wealth is a capital levy.

It is levied on the companies net assets indicated on their balance sheet at the end of a tax period. Luxembourg is a unique gateway to the European market 500 million plus consumers and around 70 of the EUs wealth are concentrated in a 700-kilometre area around the Grand. Wealth Management BudgetingSaving.

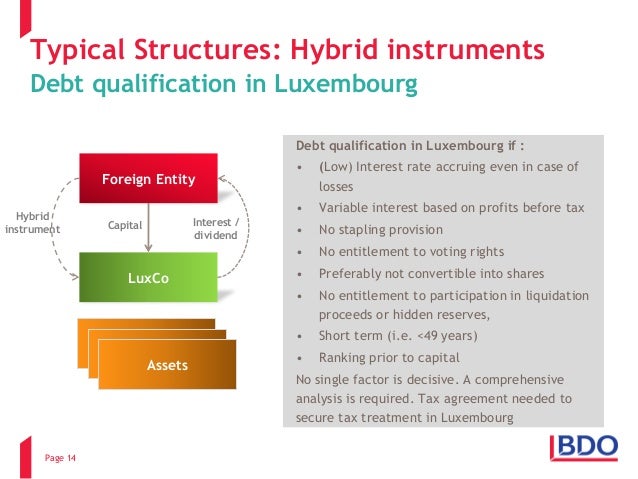

The Luxembourg law implementing the hybrid mismatch measures in ATAD 2 2017952 EU Anti-Tax Avoidance Directive into domestic law was approved by the parliament and published on 23 December 2019The ATAD 2 is largely inspired by Action 2 Neutralizing the Effects of Hybrid Mismatch Arrangements of the OECDs base erosion and profit shifting project. Capital companies are fiscally opaque ie. Our continued investments in people processes and technology are enabling us to reshape our clients futures allowing you to move with.

WIDworld overcomes this limitation by combining different data sources. Either way as one well respected international tax adviser made clear the methods of tax mitigation used in the past such as the expenses from intra-company royalty payments between overseas subsidiaries similar to those incurred legitimately between Amazons European HQ in Luxembourg and its various country operations which helped it. Expand the reach and value of Tax for your business.

Are similar to open-end mutual funds in the US. Delivering tax services insights and guidance on US tax policy tax reform legislation registration and tax law.

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

Luxembourg Private Equity Real Estate Luxembourg Sif And Sicar Ogier

Luxembourg Main Tax Measures Of The 2021 Draft Budget Law Announced During State Of The Nation Speech

Luxembourg Tax Income Taxes In Luxembourg Tax Foundation

Draft Budget Law 2021 Reduced Subscription Tax For Sustainable Investment Funds Ey Luxembourg

Silicon Valley Giants Accused Of Avoiding 100 Billion In Taxes

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

Corporate Income Tax Business Guichet Lu Administrative Guide Luxembourg

Guide To The Corporate Tax Rate In Luxembourg Expatica

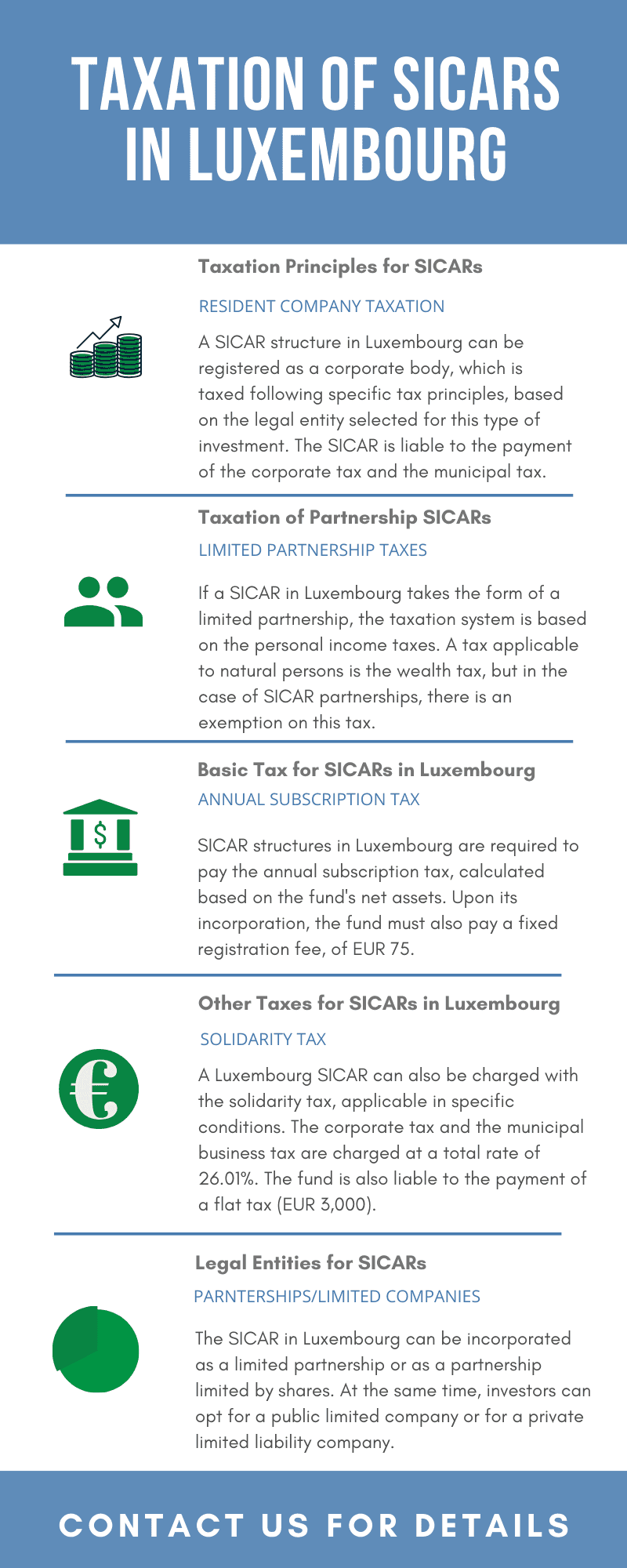

Taxation Of Sicar In Luxembourg

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

Tax In Luxembourg Implications For Dual Citizenship

Luxembourg Tax Revenue 1995 2021 Ceic Data

Luxembourg Market Profile Hktdc Research

Most Attractive Countries For Opening Investment Funds

Luxembourg Approves First Asset Manager To Manage Crypto Assets

Dentons Global Tax Guide To Doing Business In Luxembourg

Conversable Economist Why Have Other Countries Been Dropping Their Wealth Taxes

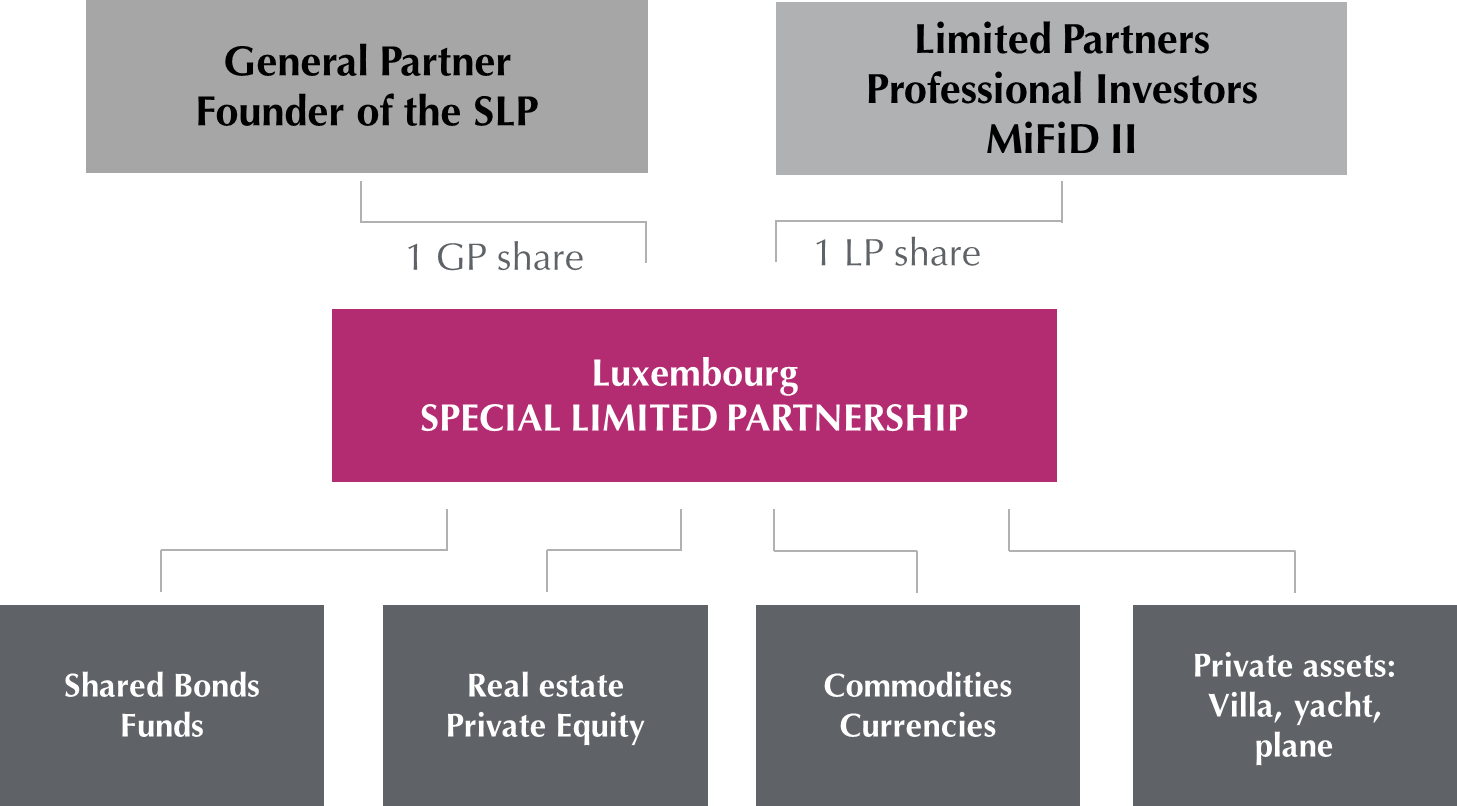

Special Limited Partnership Slp As An Alternative Investment Fund

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

Dentons Global Tax Guide To Doing Business In Luxembourg

Openlux The Secrets Of Luxembourg A Tax Haven At The Heart Of Europe

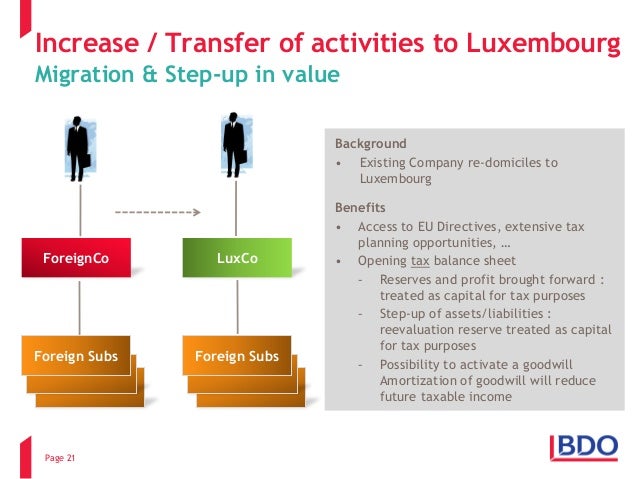

Using Luxembourg In International Structures

Patent Box Regimes In Europe 2021 Tax Foundation

International Taxation And Luxembourg S Economy In Imf Working Papers Volume 2020 Issue 264 2020

Luxembourg 2021 Budget Law Overview Of The Key Changes Lexology

0 Response to "net wealth tax luxembourg"

Post a Comment